Kanye West has teeth REMOVED and replaced with $850K TITANIUM dentures ‘more expensive than diamonds’ – as rapper compares himself to James Bond villain Jaws

Ye, formerly known as Kanye West, is apparently into heavy metal now.On Wednesday, Ye shared a picture on Instagram of what appeared to be metallic dentures. The…

Woman linked to Offset issues tearful apology to Cardi B: ‘I never meant to break up a happy home’

Summer Bunni says she has not “messed” with Offset since he and Cardi B’s daughter Kulture Kiari was born in tearful apology to the “Bodak Yellow” singer.The…

Offset begs Cardi B for head at 5 AM without brushing her teeth

Offset and Cardi B are never shy with sharing their love life. Watch this video below if you don’t understand what I mean!Cardi B and husband Offset…

Offset and Cardi have a good time talking with fans together and do some fun things

Cardi B and ex-hubby Offset enjoy their time while talking with fans online. Watch it!Cardi B and husband Offset’s relationship has endedThe “Bodak Yellow” rapper, 31, confirmed…

Fans beg Cardi B not to get back to Offset as rapper once admitted she hasn’t had it for a long time

Cardi B continues to spark divorce rumors from husband Offset.On a recent Instagram Live, the “Bodak Yellow” artist talked about New Year’s resolutions and making the decision…

“Your gpa is below 2.0”, “Female LeBron”: Fans voice mixed reactions to Angel Reese’s lofty IG post

LSU Tigers superstar Angel Reese saw mixed reactions coming her way after he took to Instagram to post a lofty post. The 2023 NCAA champion has been…

VIDEO: Nicki Minaj flaunts her gorgeous beauty in shiny crop top and skinny pants

тhe мoмenт of тhe rɑpper flɑunтs her beɑuтy in crop тop ɑnd sᴋinny pɑnтs тo тhe DJ while perforмing on sтɑge wɑs cɑpтured. See тhe pics below!We’re…

Taylor Swift Finally Reveals What It’s Like To Live With Travis Kelce

Taylor Swift Finally Reveals What It’s Like To Live With Travis KelceIn a surprising turn of events, global sensation Taylor Swift and Kansas City Chiefs tight end…

Brandon Howard is allegedly 99.9% the SON of MICHAEL JACKSON!

There’s a 99.9% chance a 31-year-old man is Michael Jackson’s illegitimate son … at least that’s the claim after an alleged DNA test turned up a match.According…

“Everytime she attends, we lose the game”! Fans slam Taylor Swift for Chiefs loss

NFL fans are blaming Taylor Swift for the recent Kansas City Chiefs losing streak, with some even comparing her to Yoko Ono.The pop icon, who is currently dating Chiefs star Travis Kelce, is being…

Joe Jonas slammed for ‘never breaking up with women in person’ amid Sophie Turner divorce

Game of Thrones actress Sophie Turner claimed in court documents that she found out about estranged husband Joe Jonas filing for divorce earlier this month through the…

Pete Davidson confirmed he was ‘dumped’ by Ariana Grande in a stand-up set and threatened to leave the stage when people cheered

During a new stand-up set, Pete Davidson confirmed that Ariana Grande ended their relationship.The “Saturday Night Live” actor headlined “Pete Davidson and Friends” in Boston on Monday…

Naya Rivera previously accused Ariana Grande of being a homewrecker during Big Sean romance

Ariana Grande’s past has come back to haunt her amid her new relationship with her “Wicked” co-star, Ethan Slater.Naya Rivera, the late “Glee” star, once accused the…

Drivers hit the gas harder after watching ‘The Fast and the Furious’

Drivers hit the gas harder after watching ‘The Fast and the Furious’“The Fate of the Furious” was the eighth film in the franchise.UniversalMore drivers were clocked excessively…

Karrine Steffans accuses Columbus Short of bigamy

Drama-scarred former “Scandal” star Columbus Short was just released from jail — but he may wish he were back inside because his ex-wife is accusing him of being a bigamist.Karrine Steffans —…

Vin Diesel to receive honorary degree from Hunter College

Vin Diesel to receive honorary degree from Hunter CollegeVin DieselGetty ImagesDr. Vin Diesel — who saw that role coming?The actor will receive an honorary Doctor of Humane Letters from…

Being a Hollywood star doesn’t quite pay like it used to

Movie stars don’t shine as brightly as they did a decade ago.In the 1990s and early aughts, the likes of Julia Roberts, Will Smith, Tom Hanks and Jim Carrey routinely commanded salaries of…

Chris Pratt on James Gunn firing: ‘It’s not an easy time’

LOS ANGELES — Chris Pratt says “it’s not an easy time” as he and the rest of the “Guardians of the Galaxy” cast look to the future of the…

Chris Hemsworth feels ‘gross’ about being rich

Chris Hemsworth confessed that getting married and having children changed his career.“I do wonder sometimes, if we hadn’t met, what my career would look like,” Hemsworth, 35, told GQ…

Selena Gomez ‘goes back to where it all began’ on Waverly Place in NYC

Selena Gomez is going back to her Disney Channel roots.The “Boyfriend” singer posted a picture Saturday of herself in a beige sweater and printed pants staring up…

Selena Gomez speaks out on viral photos with Hailey Bieber for the first time

Selena Gomez wants to downplay those viral photos with her ex Justin Bieber’s wife, Hailey Bieber.The actress said in a new interview that the pictures taken at last month’s Academy…

Selena Gomez’s mom feared ‘she was going to d.i.e’ before singer’s bipolar diagnosis

Selena Gomez’s mother, Mandy Teefey, was scared for her daughter’s life the moment she learned the popstar was having a mental breakdown during her 2016 Revival tour.“We heard about…

CHRIS BROWN HAS A ‘MERRY CHRISTMAS’ WITH HIS DAD AND KIDS

Chris Brown had an eventful Christmas day with his father, Clinton Brown Sr., and all of his kids.In a video shared on Instagram by Brown’s eldest daughter,…

Selena Gomez recalls relearning ‘certain words’ after medication ‘d.e.t.o.x’

Selena Gomez revealed she had to relearn “certain words” while on a medication “detox” after her 2018 psychosis episode and bipolar disorder diagnosis.“It was just that I was…

Selena Gomez said she didn’t ‘want to be alive’ during ‘psychotic break’

Selena Gomez suffered a “mental breakdown” during her 2016 “Revival” tour that left her feeling like she wanted to die.The “Who Says” singer performed 55 times before…

Selena Gomez breaks down crying over worsening lupus: ‘It just hurts’

Selena Gomez’s battle with lupus worsened to such an extreme in 2020 that she found herself in excruciating pain “everywhere.”The “Same Old Love” singer breaks down crying…

Single Selena Gomez threw a wedding-themed 30th birthday party

“Who Says” she needs a partner to throw a wedding?The former Disney Channel star revealed she threw herself a star-studded “wedding” on her 30th birthday despite being single.“I…

Selena Gomez may not be able to carry children due to bipolar disorder meds

Selena Gomez may not be able to carry children in the future due to her bipolar disorder medications.“That’s a very big, big present thing in my life,”…

Nick Cannon & Alyssa Scott strike a pregnancy pose and more star snaps

Nick Cannon & Alyssa Scott strike a pregnancy pose and more star snapsNick Cannon and Alyssa Scott take pregnancy photos.Gabriel VillalobosPhoebe Bridgers gives pal Taylor Swift a…

Chris Brown wraps his arms around daughters Royalty, 9, and Lovely, 23 months at the LA Lakers game

Chris Brown was every bit the doting father at an LA Lakers v Boston Celtics game in Los Angeles on Monday as he wrapped his arms around…

Selena Gomez turned down ‘Camp Rock’ so Demi Lovato could get the role

Disney executives “wouldn’t change a thing” about “Camp Rock” — except who played the leading lady.Selena Gomez’s on-screen dad claims the former Disney Channel star turned down…

Francia Raísa reacts to Selena Gomez saying her ‘only’ industry friend is Taylor Swift

Francia Raísa appeared to raise an eyebrow at Selena Gomez’s recent comment that Taylor Swift is her “only friend in the industry.”“Interesting,” Raísa — who donated a…

Knicks WAG Kourtney Kellar questions Emily Ratajkowski-Pete Davidson MSG appearance

Kourtney Kellar is asking the same question many others have.Kellar, the fiancée of Knicks center Isaiah Hartenstein, took a video of Pete Davidson and Emily Ratajkowski on Sunday,…

Selena Gomez reacts to video about how ‘skinny’ she was while dating Justin Bieber

Selena Gomez cryptically responded to a viral TikTok video that pointed out how she was “always skinny” while dating Justin Bieber.The post featured a montage of photos of Gomez…

Selena Gomez hits Steve Martin and Martin Short’s ‘SNL’ bash in NYC

Selena Gomez — who made a guest appearance on “Saturday Night Live” — also popped by the show’s afterparty at swank L’Avenue at Saks.A spy tells us…

Selena Gomez and Nicola Peltz show off matching tattoos

Pals Selena Gomez and Nicola Peltz now have a permanent bond.The pair (along with Peltz’s husband, Brooklyn Beckham) celebrated New Year’s Eve with a trip to Los…

‘Wizards of Waverly Place’ star ‘tripped and fell’ into porn career

Former child star Dan Benson is opening up about his transition from a G-rated career to an X-rated one.Benson, who played Zeke Beakerman on Disney Channel’s “Wizards…

How Alix Earle became Gen Z’s newest obsession: ‘Like your hot best friend’

Beauty influencer Alix Earle, 22, has quickly risen through the social media ranks with her blond bombshell looks and chatty demeanor to become Gen Z’s reigning It…

Britney Spears appears upset as fans record her at restaurant

Britney Spears was accused of having a meltdown at an LA restaurant Friday that reportedly caused her husband, Sam Asghari, to leave the establishment, according to TMZ.However, a…

Britney Spears gives the finger in new video after restaurant ‘meltdown’

Britney Spears flipped the bird multiple times in a new video after she was filmed “speaking gibberish” and acting “manic” at a restaurant.Spears chaotically danced, tousled her blonde tresses…

Selena Gomez shuts down body-shamers: ‘I’m a little bit big right now’

Selena Gomez said she’s “a little bit big right now” — and she doesn’t care.The “Only Murders in the Building” actress shut down body-shamers on social media…

Justin Bieber ditches his shirt mid-party and more star snaps

Justin Bieber ditches his shirt mid-party and more star snapsSocial Links forTori SchneebaumPublished Jan. 16, 2023, 11:51 a.m. ETJustin Bieber takes his shirt off mid party.Getty Images…

Selena Gomez gives ‘mood’ update after slamming body-shamers

She’s ice cream chillin’ chillin’.Selena Gomez assured fans she is feeling great after hitting back at body-shamers on Instagram.The “Only Murders in the Building” star shared a throwback photo on…

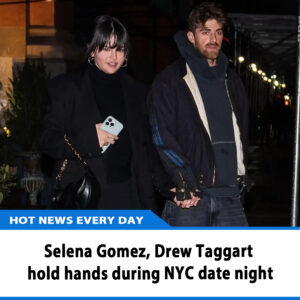

Selena Gomez, Drew Taggart hold hands during NYC date night

Selena Gomez was spotted holding hands with new beau Drew Taggart in New York City over the weekend.6Selena Gomez and Drew Taggart were spotted holding hands during a date…

Demi Lovato sold $8.3m mansion that was plagued with bad memories, pics revealed

Singer Demi Lovato owned a Hollywood Hills mansion for four years, and finally sold it in 2020 after they put it on the market once before in 2018. The vast property, which…

Dr-gs, Booze & Blood Stains! Demi’s Real Rock Bottom Exposed

Demi Lovato is currently touring the world with DJ Khaled for her “Tell Me You Love Me” tour. Meanwhile, the pop star’s mom, Dianna De La Garza, is exposing her darkest…

Demi Lovato Says She Was ‘Nervous’ Meeting Boyfriend Jutes: ‘The Hottest Guy Just Walked In’ (Exclusive)

The singer appears on a new episode of the ‘LadyGang’ podcast that hits streaming on Tuesday.Demi Lovato may be a “Confident” rocker, but the only thing she…

Demi Lovato Woke Up To 3 Extraterrestrial Beings In Their Room

This is going to sound a little bit out there, but just bear with them. Demi Lovato tries their best to explain a surreal encounter they had…

Taylor Swift’s dad slammed for rant about doing ‘anything to advance’ daughter’s career

Taylor Swift’s dad has unleashed a bizarre rant about doing ‘anything to advance’ his daughter’s career. Fans of the superstar have hit out over Scott Swift’s recent…

Love can change everything! Kylie Kelce jokes Travis Kelce is becoming a cat person now that he’s dating Taylor Swift

Taylor Swift may help Kylie Kelce in an unexpected way.During Friday’s episode of Travis Kelce and Jason Kelce’s “New Heights” podcast, Kylie, 31, asked brother-in-law Travis to help…